Starting at $19 for up to 200 orders/month

View PricingOverview

What is TaxJar?

TaxJar offers automated sales tax reporting and filing. According to the vendor, capabilities include:Accurate, Detailed Sales Tax Reports: TaxJar’s local jurisdiction reports show sales and sales tax collected not only for each state, but for local jurisdiction (counties, cities, special…

Recent Reviews

Popular Features

- Tax Data Reporting (5)9.898%

- Sales and Use Taxes (6)9.797%

- 3rd-Party Software Integrations (6)8.787%

Pricing

Starter

$19

Cloud

for up to 200 orders/month

Professional

$99

Cloud

for up to 200 orders/month

Premium

Custom

Cloud

Entry-level set up fee?

- Setup fee optionalOptional

For the latest information on pricing, visithttp://www.taxjar.com/pricing

Offerings

- Free Trial

- Free/Freemium Version

- Premium Consulting/Integration Services

Product Demos

TaxJar Demo

YouTube

Website navigation demo for TaxJar

YouTube

Demo for TaxJar

YouTube

TaxJar NAV Tax Rate Integration Demo

YouTube

Features

Return to navigation

Product Details

- About

- Integrations

- Competitors

- Tech Details

- Downloadables

- FAQs

What is TaxJar?

TaxJar offers automated sales tax reporting and filing.

According to the vendor, capabilities include:

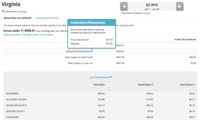

Accurate, Detailed Sales Tax Reports: TaxJar’s local jurisdiction reports show sales and sales tax collected not only for each state, but for local jurisdiction (counties, cities, special jurisdictions, etc). Users can also sort data by any date range.

Estimated Sales Tax Reports: Users can see a comparison of what they actually collected versus what they should have collected.

One-Click Automated Filing: TaxJar will automatically file sales tax returns directly to the states. Available in 23 states with more to come.

Up-to-Date Collection Data: A dashboard shows how much has been collected in sales tax for any state, and when the next payment is due. Data is updated automatically, every day.

Support for Multiple Channels: Connect to platforms like eBay and Amazon.

Simple Pricing: No setup fees. No contracts. Users pay one simple monthly fee based on volume of transactions.

According to the vendor, capabilities include:

Accurate, Detailed Sales Tax Reports: TaxJar’s local jurisdiction reports show sales and sales tax collected not only for each state, but for local jurisdiction (counties, cities, special jurisdictions, etc). Users can also sort data by any date range.

Estimated Sales Tax Reports: Users can see a comparison of what they actually collected versus what they should have collected.

One-Click Automated Filing: TaxJar will automatically file sales tax returns directly to the states. Available in 23 states with more to come.

Up-to-Date Collection Data: A dashboard shows how much has been collected in sales tax for any state, and when the next payment is due. Data is updated automatically, every day.

Support for Multiple Channels: Connect to platforms like eBay and Amazon.

Simple Pricing: No setup fees. No contracts. Users pay one simple monthly fee based on volume of transactions.

TaxJar Screenshots

TaxJar Integrations

- Amazon Web Services

- Shopify

- Shopify Plus

- WooCommerce

- Square POS

- PayPal Payments Pro

- Stripe Payments

- BigCommerce

- BigCommerce Enterprise Unpublished

- Ecwid by Lightspeed

- Zoey

- Magento Commerce

- part of Adobe Commerce Cloud

- Magento Open Source (formerly Community Edition)

- eBay

- Etsy

TaxJar Competitors

TaxJar Technical Details

| Deployment Types | Software as a Service (SaaS), Cloud, or Web-Based |

|---|---|

| Operating Systems | Unspecified |

| Mobile Application | No |

| Supported Countries | United States, Canada, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom |

| Supported Languages | English |

TaxJar Downloadables

Frequently Asked Questions

Reviewers rate Geolocation for Tax Assessment highest, with a score of 10.

The most common users of TaxJar are from Small Businesses (1-50 employees).